-

Table of Contents

- Introduction

- Understanding the Basics: Stocks vs. Shares

- Key Differences: Stocks and Shares Explained

- Investing 101: Differentiating Stocks from Shares

- Stocks vs. Shares: Which is Right for You?

- Demystifying Stocks and Shares: A Comparative Analysis

- Stocks vs. Shares: Unraveling the Distinctions

- Investment Insights: Decoding Stocks and Shares

- Comparing Stocks and Shares: An Investor’s Perspective

- Stocks and Shares: What Sets Them Apart?

- Navigating the Market: Stocks vs. Shares

- Conclusion

Stocks vs. Shares: Understanding the Distinction

Introduction

Stocks and shares are often used interchangeably, but they have slightly different meanings in the world of finance. While both represent ownership in a company, stocks generally refer to ownership in a specific company, while shares can refer to ownership in any company or multiple companies.

Understanding the Basics: Stocks vs. Shares

What is the difference between stocks and shares? If you’re new to the world of investing, these terms may seem interchangeable. However, there are subtle differences between the two that are important to understand. In this article, we will break down the basics of stocks and shares, helping you gain a clearer understanding of these terms.

Let’s start with stocks. When you hear someone talking about stocks, they are referring to ownership in a particular company. Stocks represent a share of ownership in a corporation. When you buy stocks, you become a shareholder, which means you have a claim on the company’s assets and earnings. Shareholders also have the right to vote on certain company matters, such as electing board members.

On the other hand, shares are a unit of ownership in a company. They are essentially the same as stocks, but the term “shares” is often used in a more general sense. For example, when a company goes public and offers ownership to the public, they issue shares of stock. These shares can then be bought and sold on the stock market.

So, to summarize, stocks and shares are essentially the same thing. They both represent ownership in a company. However, “stocks” is the more specific term, referring to ownership in a particular company, while “shares” is a more general term used to describe ownership units in any company.

Now that we have a basic understanding of stocks and shares, let’s explore some key concepts related to investing in them. One important concept is stock exchanges. Stock exchanges are where stocks and shares are bought and sold. The most well-known stock exchange is the New York Stock Exchange (NYSE), but there are many others around the world, such as the London Stock Exchange and the Tokyo Stock Exchange.

When you buy or sell stocks or shares, you do so through a broker. A broker is a person or a firm that acts as an intermediary between buyers and sellers. They facilitate the buying and selling process and charge a fee or commission for their services. It’s important to choose a reputable broker who can provide you with the necessary guidance and support.

Another important concept to understand is stock indices. Stock indices are measures of the performance of a group of stocks. They provide a snapshot of how a particular market or sector is performing. Some well-known stock indices include the S&P 500, which tracks the performance of 500 large-cap U.S. stocks, and the FTSE 100, which tracks the performance of the 100 largest companies listed on the London Stock Exchange.

In conclusion, while the terms “stocks” and “shares” are often used interchangeably, there are subtle differences between the two. Stocks refer to ownership in a specific company, while shares are a more general term used to describe ownership units in any company. Understanding these basics is crucial for anyone looking to invest in the stock market. So, whether you’re considering buying stocks or shares, make sure to do your research, consult with a reputable broker, and keep an eye on stock indices to make informed investment decisions.

Key Differences: Stocks and Shares Explained

What is the difference between stocks and shares? This is a question that often confuses people, as the terms are often used interchangeably. However, there are some key differences between stocks and shares that are important to understand.

Firstly, let’s start with the basics. Both stocks and shares represent ownership in a company. When you buy stocks or shares, you are essentially buying a piece of that company. This means that you have a claim on the company’s assets and earnings.

The main difference between stocks and shares lies in how they are traded. Stocks are typically traded on stock exchanges, such as the New York Stock Exchange or the London Stock Exchange. These exchanges provide a centralized marketplace where buyers and sellers can come together to trade stocks.

On the other hand, shares are often traded on smaller, decentralized platforms. These platforms, known as over-the-counter markets, allow for direct trading between buyers and sellers. This means that shares can be traded without the need for a centralized exchange.

Another difference between stocks and shares is the way they are issued. Stocks are typically issued by large, publicly traded companies. These companies often issue millions or even billions of shares to the public. This allows for widespread ownership and liquidity in the market.

Shares, on the other hand, are often issued by smaller, privately held companies. These companies may issue a limited number of shares to a select group of investors. This means that shares are often less liquid than stocks, as there may be fewer buyers and sellers in the market.

When it comes to voting rights, stocks and shares also differ. Stocks typically come with voting rights, which means that shareholders have a say in the company’s decision-making process. This can include voting on matters such as the election of the board of directors or major corporate decisions.

Shares, on the other hand, may or may not come with voting rights. This depends on the specific terms of the share issuance. In some cases, shares may have limited or no voting rights, which means that shareholders do not have a say in the company’s decision-making process.

Finally, stocks and shares can also differ in terms of dividends. Dividends are payments made by a company to its shareholders as a share of its profits. Stocks are more likely to pay dividends, as they are typically issued by larger, more established companies with stable earnings.

Shares, on the other hand, may or may not pay dividends. This depends on the specific terms of the share issuance and the financial performance of the company. Smaller, privately held companies may choose to reinvest their profits back into the business rather than paying dividends to shareholders.

In conclusion, while stocks and shares are often used interchangeably, there are some key differences between the two. Stocks are typically traded on stock exchanges, while shares are often traded on smaller, decentralized platforms. Stocks are issued by large, publicly traded companies, while shares are often issued by smaller, privately held companies. Stocks typically come with voting rights and are more likely to pay dividends, while shares may or may not have voting rights and may or may not pay dividends. Understanding these differences can help investors make informed decisions when it comes to buying and selling stocks and shares.

Investing 101: Differentiating Stocks from Shares

Investing 101: Differentiating Stocks from Shares

If you’re new to the world of investing, you may have come across the terms “stocks” and “shares” and wondered if they mean the same thing. While they are often used interchangeably, there is a subtle difference between the two. In this article, we will explore what sets stocks apart from shares and help you understand the nuances of these terms.

Let’s start by defining what stocks and shares are. In simple terms, both stocks and shares represent ownership in a company. When you buy stocks or shares, you become a partial owner of that company, entitled to a portion of its profits and assets. However, the distinction lies in how these ownership interests are structured.

Shares refer to the individual units of ownership in a company. When a company decides to divide its ownership into smaller portions, it issues shares. These shares are then sold to investors, who become shareholders in the company. Each share represents a specific percentage of ownership and carries certain rights, such as voting rights in company decisions.

On the other hand, stocks are a broader term that encompasses shares and other types of ownership interests. While shares are specific to individual companies, stocks can refer to ownership in multiple companies. Stocks are often traded on stock exchanges, where investors can buy and sell them. When people talk about investing in the stock market, they are usually referring to buying and selling stocks.

To put it simply, shares are like puzzle pieces that make up the ownership of a single company, while stocks are like a collection of puzzle pieces from different companies. When you buy shares, you are acquiring ownership in a specific company, whereas buying stocks allows you to own a piece of multiple companies.

It’s important to note that the terms “stocks” and “shares” can vary in usage depending on the country. In some regions, such as the United States, the term “stock” is commonly used, while in others, like the United Kingdom, “share” is the preferred term. However, the underlying concept remains the same – ownership in a company.

Understanding the difference between stocks and shares is crucial for investors, as it affects the way they approach investing. When you invest in shares, you are focusing on a specific company and its performance. You need to research and analyze the company’s financials, industry trends, and other factors that may impact its value. On the other hand, investing in stocks requires a broader perspective, as you need to consider the performance of multiple companies and diversify your portfolio.

In conclusion, while stocks and shares are often used interchangeably, there is a subtle difference between the two. Shares represent ownership in a specific company, while stocks encompass ownership in multiple companies. By understanding this distinction, investors can make informed decisions and navigate the world of investing more effectively. So, whether you’re considering buying shares in a single company or investing in a diverse portfolio of stocks, remember to do your research and consult with a financial advisor to make the most of your investment journey.

Stocks vs. Shares: Which is Right for You?

What is the difference between stocks and shares? This is a question that many people ask when they are first starting to invest in the stock market. While the terms “stocks” and “shares” are often used interchangeably, there are actually some subtle differences between the two.

First, let’s start with the basics. Both stocks and shares represent ownership in a company. When you buy a stock or a share, you are essentially buying a piece of that company. This means that you have a claim on the company’s assets and earnings.

So, what is the difference? Well, the term “stock” is often used to refer to ownership in a publicly traded company. These are companies that have shares that are bought and sold on a stock exchange, such as the New York Stock Exchange or the London Stock Exchange. When you buy a stock, you are buying a share of ownership in that company.

On the other hand, the term “share” is often used to refer to ownership in a private company. These are companies that are not publicly traded and do not have shares that are bought and sold on a stock exchange. Instead, ownership in these companies is typically held by a small group of individuals or by a single individual.

Another difference between stocks and shares is the level of risk involved. Generally speaking, investing in stocks carries more risk than investing in shares. This is because publicly traded companies are subject to more scrutiny and regulation than private companies. Additionally, the value of stocks can fluctuate greatly based on market conditions and investor sentiment.

Shares, on the other hand, tend to be less volatile and more stable in value. This is because private companies are not subject to the same level of market forces as publicly traded companies. However, it’s important to note that investing in any type of ownership in a company carries some level of risk, and it’s important to do your research and understand the potential risks before investing.

When it comes to deciding whether stocks or shares are right for you, it really depends on your individual circumstances and investment goals. If you are looking for potentially higher returns and are comfortable with taking on more risk, then investing in stocks may be the right choice for you. On the other hand, if you are looking for a more stable and predictable investment, then shares in a private company may be a better fit.

Ultimately, the decision between stocks and shares comes down to your personal preferences and risk tolerance. It’s important to carefully consider your investment goals and do your research before making any investment decisions. Consulting with a financial advisor can also be helpful in determining the best investment strategy for your individual needs.

In conclusion, while the terms “stocks” and “shares” are often used interchangeably, there are some differences between the two. Stocks typically refer to ownership in publicly traded companies, while shares typically refer to ownership in private companies. Stocks tend to be more volatile and carry more risk, while shares tend to be more stable. The decision between stocks and shares ultimately depends on your individual circumstances and investment goals.

Demystifying Stocks and Shares: A Comparative Analysis

What is the difference between stocks and shares? This is a question that often confuses people, as the terms are often used interchangeably. However, there are some key differences between the two that are important to understand. In this article, we will demystify stocks and shares by providing a comparative analysis.

Firstly, let’s start by defining what stocks and shares actually are. Both stocks and shares represent ownership in a company. When you buy a stock or a share, you are essentially buying a piece of that company. This means that you have a claim on the company’s assets and earnings.

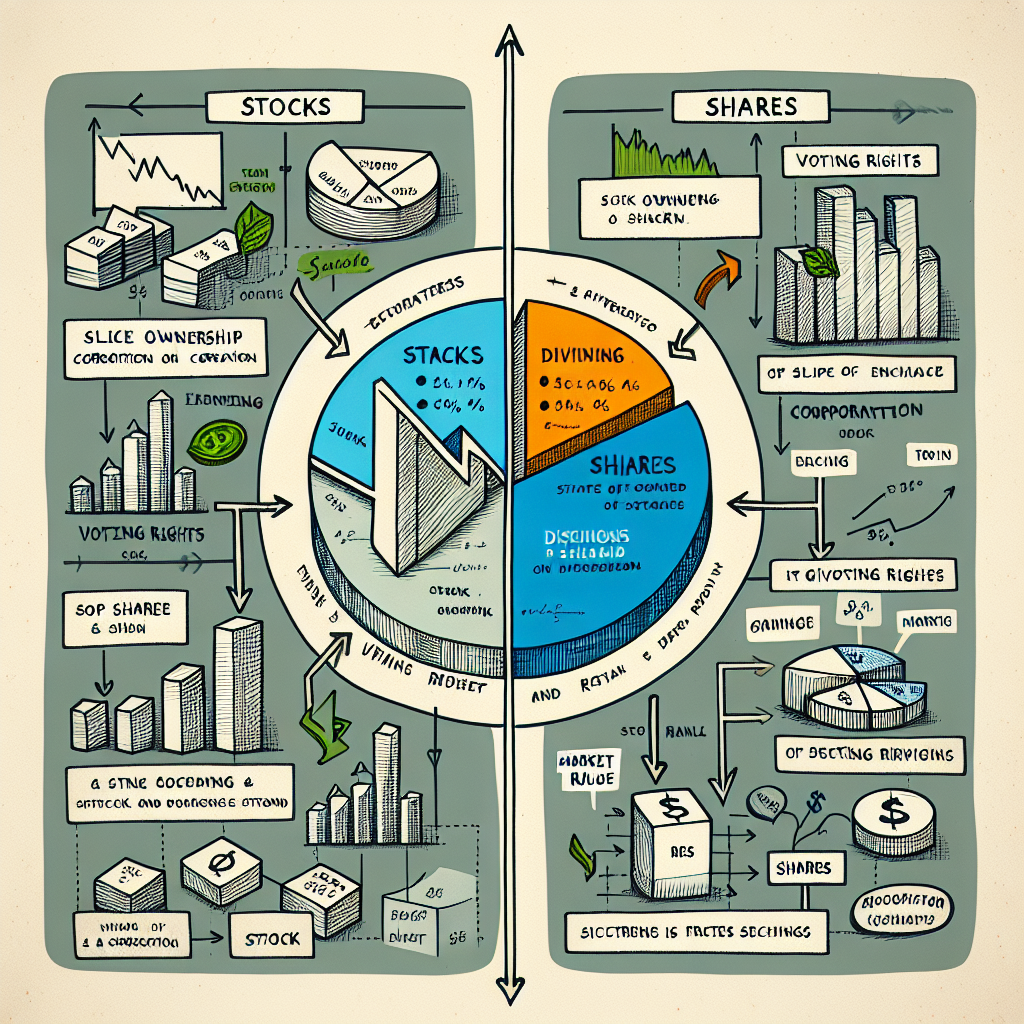

Now, let’s delve into the differences between stocks and shares. The term “stock” is often used to refer to ownership in a company in a general sense. It is a broader term that encompasses different types of ownership, including shares. On the other hand, “shares” specifically refer to the individual units of ownership in a company. So, while all shares are stocks, not all stocks are shares.

Another difference between stocks and shares lies in how they are issued. Stocks are typically issued by public companies that are listed on a stock exchange. These stocks can be bought and sold by anyone on the open market. On the other hand, shares are often issued by private companies that are not publicly traded. These shares are usually held by a limited number of individuals or entities, such as the company’s founders, employees, or venture capitalists.

When it comes to voting rights, stocks and shares also differ. In general, each share of stock carries one vote in the company’s decision-making process. This means that the more shares you own, the more voting power you have. However, some stocks may have different classes, such as Class A and Class B shares, which may have different voting rights. On the other hand, shares in a private company may not come with any voting rights at all.

One important aspect to consider when investing in stocks or shares is the level of risk involved. Stocks, especially those of publicly traded companies, are generally considered to be more liquid and less risky compared to shares of private companies. This is because stocks can be easily bought and sold on the open market, providing investors with the ability to quickly exit their positions if needed. Shares of private companies, on the other hand, are often illiquid and can be difficult to sell. Additionally, private companies may carry a higher level of risk due to their limited financial disclosures and the potential for a lack of market demand for their shares.

In conclusion, while the terms “stocks” and “shares” are often used interchangeably, there are some important differences between the two. Stocks are a broader term that encompasses different types of ownership, including shares. Shares specifically refer to the individual units of ownership in a company. Stocks are typically issued by public companies and can be bought and sold on the open market, while shares are often issued by private companies and may be held by a limited number of individuals. Additionally, stocks generally come with voting rights, while shares may or may not have voting rights. Understanding these differences is crucial for anyone looking to invest in the stock market or private companies.

Stocks vs. Shares: Unraveling the Distinctions

What is the difference between stocks and shares? This is a question that often confuses people, as the terms are often used interchangeably. However, there are some key distinctions between the two that are important to understand.

Firstly, let’s start with the basics. Both stocks and shares represent ownership in a company. When you buy stocks or shares, you are essentially buying a piece of that company. This means that you have a claim on the company’s assets and earnings.

So, what is the difference? Well, the term “stock” is often used to refer to ownership in a publicly traded company. These are companies that have shares that are listed on a stock exchange, such as the New York Stock Exchange or the London Stock Exchange. When you buy stocks in a publicly traded company, you are buying shares that are traded on these exchanges.

On the other hand, the term “share” is often used to refer to ownership in a private company. These are companies that are not listed on a stock exchange and do not have publicly traded shares. Instead, ownership in these companies is typically held by a small group of individuals or investors.

Another important distinction between stocks and shares is the level of risk involved. Generally speaking, investing in stocks carries a higher level of risk compared to investing in shares. This is because publicly traded companies are subject to market forces and can be influenced by factors such as economic conditions, industry trends, and investor sentiment. On the other hand, private companies are typically less exposed to these external factors and may offer a more stable investment option.

In terms of liquidity, stocks are generally more liquid compared to shares. This means that it is easier to buy and sell stocks on a stock exchange compared to shares in a private company. This is because there is a larger pool of buyers and sellers for stocks, which makes it easier to find a buyer or seller when you want to trade your shares.

When it comes to dividends, stocks and shares also differ. Dividends are payments made by a company to its shareholders as a share of its profits. While both stocks and shares can potentially pay dividends, publicly traded companies are more likely to do so. This is because they have a larger number of shareholders and are often required by law to distribute a portion of their profits as dividends.

In conclusion, while the terms “stocks” and “shares” are often used interchangeably, there are some important distinctions between the two. Stocks typically refer to ownership in publicly traded companies, while shares refer to ownership in private companies. Stocks are generally more liquid and carry a higher level of risk compared to shares. Additionally, publicly traded companies are more likely to pay dividends compared to private companies. Understanding these differences can help investors make informed decisions when it comes to investing in stocks or shares.

Investment Insights: Decoding Stocks and Shares

What is the difference between stocks and shares? This is a question that often confuses people who are new to the world of investing. While the terms are often used interchangeably, there is actually a subtle difference between the two.

Let’s start by defining what stocks and shares are. In simple terms, both stocks and shares represent ownership in a company. When you buy stocks or shares, you become a part-owner of that company. This means that you have a claim on the company’s assets and earnings.

The main difference between stocks and shares lies in how they are traded. Stocks are typically traded on stock exchanges, such as the New York Stock Exchange or the London Stock Exchange. These exchanges provide a centralized marketplace where buyers and sellers can come together to trade stocks.

On the other hand, shares are often traded on smaller, decentralized platforms. These platforms, known as over-the-counter markets, allow for direct trading between buyers and sellers. While stocks are traded in large volumes, shares are often traded in smaller quantities.

Another difference between stocks and shares is the way they are issued. Stocks are usually issued by large, publicly traded companies. These companies issue stocks to raise capital for various purposes, such as expanding their operations or funding new projects. When you buy stocks, you are buying a piece of the company’s ownership.

Shares, on the other hand, are often issued by smaller, privately held companies. These companies may issue shares to raise capital from a select group of investors, such as friends, family, or venture capitalists. Unlike stocks, shares are not publicly traded and are often not available to the general public.

One important thing to note is that stocks and shares can have different voting rights. When you own stocks, you typically have the right to vote on certain matters related to the company, such as electing board members or approving major decisions. However, shares may not always come with voting rights. In some cases, shares may only entitle you to a share of the company’s profits, without any voting power.

In terms of risk and return, stocks and shares can also differ. Stocks of large, publicly traded companies are generally considered less risky than shares of smaller, privately held companies. This is because larger companies tend to have more stable earnings and a broader customer base. However, shares of smaller companies can offer higher potential returns if the company is successful.

In conclusion, while stocks and shares are often used interchangeably, there are some key differences between the two. Stocks are typically traded on stock exchanges, while shares are often traded on smaller, decentralized platforms. Stocks are issued by large, publicly traded companies, while shares are often issued by smaller, privately held companies. Additionally, stocks usually come with voting rights, while shares may not. Understanding these differences can help investors make informed decisions when it comes to buying and selling stocks and shares.

Comparing Stocks and Shares: An Investor’s Perspective

What is the difference between stocks and shares? This is a question that often confuses new investors. While the terms are often used interchangeably, there are some subtle differences that can impact your investment strategy. In this article, we will compare stocks and shares from an investor’s perspective, helping you understand the nuances and make informed decisions.

Let’s start by defining the terms. In simple terms, a stock represents ownership in a company. When you buy a stock, you become a shareholder, which means you have a claim on the company’s assets and earnings. On the other hand, shares refer to the individual units of ownership in a company. Each stock is divided into shares, and investors can buy and sell these shares on the stock market.

One key difference between stocks and shares is the context in which they are used. Stocks are often used when referring to the overall ownership of a company, while shares are used to describe the individual units of ownership. For example, you might say, “I own stocks in Apple,” but when you want to specify the number of units you own, you would say, “I own 100 shares of Apple.”

Another difference lies in the way they are traded. Stocks are typically traded on stock exchanges, such as the New York Stock Exchange or NASDAQ. These exchanges provide a centralized marketplace where buyers and sellers can come together to trade stocks. Shares, on the other hand, can be traded both on stock exchanges and in over-the-counter markets. Over-the-counter trading refers to transactions that occur directly between buyers and sellers, without the involvement of a centralized exchange.

When it comes to voting rights, stocks and shares can also differ. In some cases, companies issue different classes of stock, such as Class A and Class B shares. These different classes may have different voting rights attached to them. For example, Class A shares may have more voting power than Class B shares. This distinction allows companies to maintain control while still raising capital from public investors.

From a financial perspective, stocks and shares are essentially the same. Both represent ownership in a company and entitle the holder to a share of the company’s profits. When the company performs well, the value of both stocks and shares can increase, allowing investors to make a profit. Conversely, if the company performs poorly, the value of both can decrease, resulting in a loss for investors.

In summary, while the terms stocks and shares are often used interchangeably, there are some subtle differences that investors should be aware of. Stocks refer to the overall ownership in a company, while shares represent the individual units of ownership. Stocks are traded on stock exchanges, while shares can be traded on exchanges and over-the-counter markets. Additionally, different classes of stock may have different voting rights. Ultimately, both stocks and shares offer investors the opportunity to participate in a company’s success and share in its profits.

Stocks and Shares: What Sets Them Apart?

When it comes to investing, the terms “stocks” and “shares” are often used interchangeably. However, there is a subtle difference between the two that is worth understanding. In this article, we will explore what sets stocks and shares apart and why it matters for investors.

To begin with, let’s define what stocks and shares actually are. Both refer to ownership in a company, but they represent ownership in slightly different ways. Stocks are a broader term that encompasses all types of ownership in a company, including common stock, preferred stock, and even certain types of debt securities. On the other hand, shares specifically refer to ownership in a company’s common stock.

One key distinction between stocks and shares is the rights they confer to their owners. When you own shares of common stock, you become a partial owner of the company and have the right to vote on certain matters, such as electing the board of directors. You also have the potential to receive dividends, which are a portion of the company’s profits distributed to shareholders. In contrast, other types of stocks, such as preferred stock, may not grant voting rights but offer a fixed dividend payment.

Another difference between stocks and shares lies in their marketability. Shares of common stock are typically more liquid and easily tradable on stock exchanges. They can be bought and sold by individual investors through brokerage accounts. On the other hand, certain types of stocks, such as preferred stock or debt securities, may have limited marketability and may not be as readily tradable.

The distinction between stocks and shares also becomes relevant when it comes to issuing new ownership in a company. When a company decides to raise capital by issuing additional ownership, it can do so by offering new shares of common stock. This dilutes the ownership of existing shareholders, as their percentage ownership in the company decreases. However, when a company issues new stocks, it may not necessarily affect the ownership of existing shareholders, as it could be in the form of preferred stock or debt securities.

Understanding the difference between stocks and shares is important for investors because it helps them make informed decisions. For example, if you are interested in voting on company matters or receiving dividends, you would want to invest in shares of common stock. On the other hand, if you are more interested in a fixed dividend payment and are not concerned about voting rights, preferred stock might be a better option.

Additionally, knowing the marketability of different types of stocks can help investors determine the liquidity of their investments. If you anticipate needing to sell your shares quickly, investing in common stock would be a more suitable choice.

In conclusion, while stocks and shares are often used interchangeably, there are subtle differences between the two. Stocks encompass all types of ownership in a company, while shares specifically refer to ownership in common stock. Understanding these differences can help investors make informed decisions about their investments, considering factors such as voting rights, dividend payments, and marketability.

Navigating the Market: Stocks vs. Shares

What is the difference between stocks and shares? If you’re new to the world of investing, these terms may seem interchangeable. However, there are subtle distinctions that can impact your investment strategy. In this article, we will explore the differences between stocks and shares, helping you navigate the market with confidence.

Let’s start by defining the terms. Stocks and shares both represent ownership in a company, but they are used in different contexts. Stocks are typically associated with ownership in publicly traded companies, while shares are more commonly used to refer to ownership in private companies.

When you buy stocks, you are purchasing a small piece of ownership in a publicly traded company. These companies are listed on stock exchanges, such as the New York Stock Exchange or NASDAQ. By buying stocks, you become a shareholder and have the potential to earn profits through dividends or by selling your shares at a higher price.

On the other hand, shares are often used to describe ownership in a private company. Private companies are not publicly traded and are typically owned by a small group of individuals or investors. When you buy shares in a private company, you become a shareholder and have a stake in the company’s success. However, selling shares in a private company can be more challenging than selling stocks in a publicly traded company.

Another key difference between stocks and shares is the level of regulation and transparency. Publicly traded companies are subject to strict regulations and are required to disclose financial information to the public. This transparency allows investors to make informed decisions based on the company’s performance and prospects.

Private companies, on the other hand, have more flexibility in terms of disclosure. They are not required to release financial statements or other information to the public. This lack of transparency can make it more difficult for investors to assess the value and potential risks of investing in a private company.

When it comes to liquidity, stocks have a clear advantage over shares. Publicly traded stocks can be bought and sold on stock exchanges, providing investors with the ability to quickly convert their investments into cash. This liquidity makes stocks a popular choice for investors who value flexibility and the ability to react quickly to market conditions.

Shares in private companies, on the other hand, are not as easily traded. Selling shares in a private company often requires finding a buyer who is willing to purchase the shares at a mutually agreeable price. This lack of liquidity can make it more challenging to access your investment capital when investing in private companies.

In summary, while stocks and shares both represent ownership in a company, there are important differences to consider. Stocks are associated with ownership in publicly traded companies and offer greater liquidity and transparency. Shares, on the other hand, are typically used to describe ownership in private companies and may offer less liquidity and transparency. Understanding these distinctions can help you make informed investment decisions and navigate the market with confidence.

Conclusion

In conclusion, the terms “stocks” and “shares” are often used interchangeably, but they have slight differences. Stocks refer to the ownership in a particular company, representing a portion of its overall value. On the other hand, shares are the units into which the ownership of a company is divided. Therefore, stocks are the broader concept, while shares are the specific units that represent ownership in a company.